The US Dollar has been the world’s reserve currency when the US and its Allies agreed to this at the 1944 Bretton Woods conference. What has actually bonded the dollar as the world’s reserve currency was an agreement reached with Saudi Arabia just after the Yom Kipper War in 1973 and the following first oil crisis, which was when the US agreed to protect Saudi Arabia militarily if they would require that all oil sales be made in US Dollars. Hence, this was when petrodollar was coined.

The US has seen unprecedent financial gains because of this agreement for the last 50 years. Although due to a number of recent decisions by Washington DC, the petrodollar may have seen its last days. To get an appreciation of the last 50 years, a brief history of oil and money will be explored.

History of Oil & Money

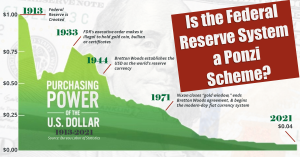

It was in 1971 when President Nixon took the dollar off the gold standard. Strangely just two years later, the US Dollar became financially attached to another standard: oil.

In 1973, the Yom Kippur War was fought between Israel and a group of Arab nations, including Egypt, Jordan and Syria. Israel won the war. The war lasted from October 6 through October 25, 1973. Prior to the end of the war on October 17, 1973, Arab oil-producing states, otherwise known as the Organization of Arab Petroleum Exporting Countries imposed an oil embargo against the nations that were supporting Israel. The initial nations targeted were Canada, Japan, the Netherlands, the United Kingdom and the United States.

This embargo led to the long gas lines in the 70s, doubling of the price of gasoline, and the price of oil soaring from $3 to $12 per barrel. This embargo was known as the first oil crisis and showed how much the world depended upon Middle Eastern oil.

This drastic rise in oil prices caused the US to try and stabilize the price of oil. A deal was struck so that the US would buy oil from Saudi Arabia and provide them with military protection. In doing so, Saudi Arabia agreed that it would conduct all oil trades with other countries in the US dollar. They would then purchase US Treasury Notes with the US dollars received from petroleum. As a result, almost all other oil producing countries traded oil for US dollars; hence, the term petrodollar was coined.

This deal between the US and Saudi Arabia hinged upon it being a secret. It remained a secret until 2016 when Bloomberg published a report about it. This agreement led to financial security for the US and the US Dollar for the last 50 years.

Back to the Present

Today Mohammed Bin Salman Al Saud (MBS) is the Crown Prince of Saudi Arabia and is in total control of the House of Saud. This royal family’s estimated net worth is 1.7 trillion dollars according to JustRichest.com.

With this much power in the hands of one person, what does this mean for the stability of the US dollar? Take a look at the top ten oil consuming nations. The 2020 barrels per day rankings include:

- United States — 17,178,000

- China — 14,225,000

- India — 4,669,000

- Saudi Arabia — 3,544,000

- Japan — 3,268,000

- Russia — 3,238,000

- South Korea — 2,560,000

- Brazil — 2,323,000

- Canada — 2,282,000

- Germany 2,045,000

Currently, these countries all purchase their oil with the US dollar. But how long will this last?

Is the Petrodollar Dying a Slow Death?

Consider this article from the Wall Street Journal. On March 15, 2022, they published “Saudi Arabia Considers Accepting Yuan Instead of Dollars for Chinese Oil Sales.” The article speaks to how the Saudis are not pleased with the decisions of Washington DC and are considering accepting the Chinese Yuan for oil instead of the US dollar.

In addition, on March 15, 2022, Bloomberg reported that the “Yuan Jumps After Report on Saudis Weighing Its Use in Oil Deals.” Should this happen, then this would impact the value of the US dollar. The almighty US dollar may have seen better days.

Consider that even Fed Chief Jerome Powell may have acquiesced to this when he said that it is possible to have more than one world’s reserve currency.

The fact that Russia on August 24, 2021, struck a direct military cooperation agreement with Saudi Arabia and that Nigeria struck a deal with Russia further shows reasons why the Petrodollar could decline. Thereby, the US Dollar may be losing its status as the world’s reserve currency

What to do?

Consider not placing all your assets in one basket by de-dollarizing into asset classes that are not at all-time highs. One of those assets is silver. To check out what I am doing with silver, go to Steve’s Silver Ventures.

Disclaimer

The above represents the opinion of Steve Sands, not only in terms of what each author has stated, but also his and based on the time of writing. Mr. Sands’ opinions are his own and are not a recommendation or an offer to buy or sell securities, commodities and/or cryptocurrencies. As trading and investing in any financial market may involve serious risk of loss, Mr. Sands recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and always do your own due diligence and research when making any kind of a transaction with financial ramifications. Although Mr. Sands has an MBA with a concentration in finance, he is not a Registered Securities Advisor; therefore, Mr. Sands’ opinions and analysis on the markets, including stocks, commodities and cryptocurrencies are his own and cannot and should not be construed as a solicitation to buy or sell.