What is a Ponzi Scheme

The best definition of a Ponize Scheme comes from the U.S. Securities and Exchange Commission (SEC). At the SEC’s website Investor.gov, it states: “A Ponzi scheme is an investment fraud that pays existing investors with funds collected from new investors.”

The original Ponzi Scheme is attributed to Charles Ponzi, who swindled his clients out of $20 million in the 1920s. Today that $20 million is worth $258 million. He promised that he would return either a 50% profit in 45 days or 100% in 90 days. The scam was that he would pay his earlier clients from the investment pool of more recent clients. This scheming, of course, depended upon his ability to continually find new clients instead of a legitimate method of investing the pool in a potentially profitable project that could grow overtime.

End of the Road

As with a scheme such as Charles Ponzi’s, there is always an end of the road. Charles was charged with 86 counts of mail fraud and faced life imprisonment.

ENDEVR provides a documentary entitled, End of the Road: How Money Became Worthless. This documentary, published on December 30, 2020, provides history of the Federal Reserve System and depicts how the Federal Reserve is in actuality a Ponzi Scheme. You can view that 56-minute video below…

Timeline of End of the Road

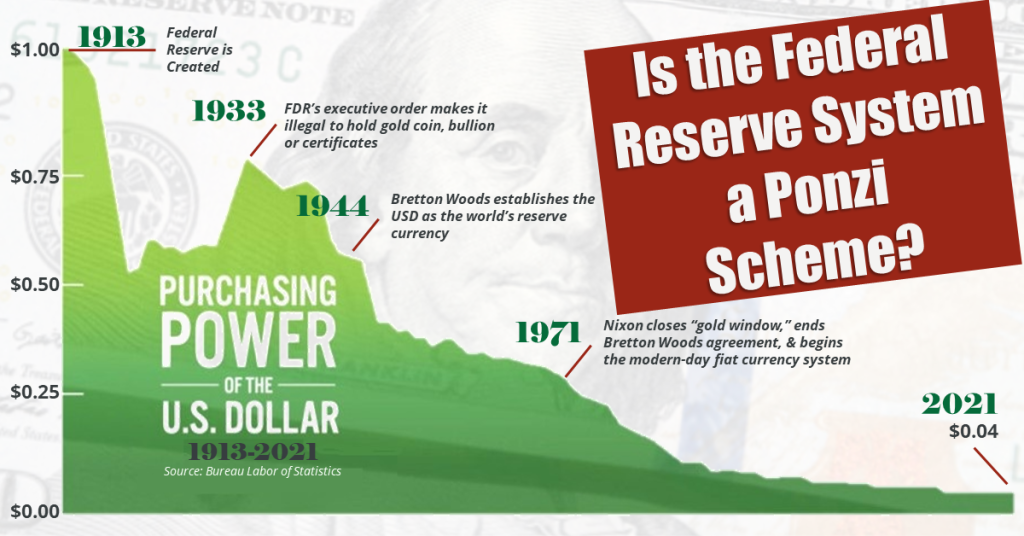

- 03:38 – In 1944, the United Nations Monetary Conference is held in Bretton Woods, New Hampshire. Forty-four countries meet to establish a monetary foreign exchange system. The system that emerged was the US dollar’s value, pegged to the value of gold, would be the standard to which all other currencies would be pegged. Essentially the US dollar could be converted to gold.

- 06:15 – In 1971, President Richard Nixon suspends the convertibility of the US dollar to gold. This meant that the US dollar and all other country’s currencies are now based on the full faith and credit of the US Government. At the time, the US dollar was as good as gold. However, from then to now, the US Government’s budget has always run a deficit. Thus, the beginning of fiat currency.

G. Edward Griffin, author of The Creature from Jekyll Island, states that governments have a right to declare something of no value, and we must accept it. - 09:50 – Griffin describes what a Ponzi scheme is.

- 11:27 – How the Federal Reserve System is a Ponzi scheme is explained.

- 14:06 – Since 1907, the US has engaged in trade deficits.

- 15:45 – Griffin details why the Federal Reserve System is a Ponzi scheme in that the US Government must keep borrowing money to pay off existing loans.

- 20:35 – Difference between core inflation and headline inflation is explained.

- 22:00 – Why countries that devalue their currency so that it becomes higher valued than the US dollar.

- 24:08 – The pains of 40 years of the failure of a fiat currency is depicted.

- 24:51 – Is the US maxed out with the amount of deficit spending? Can we take on more debt?

- 25:42 – The global economy depends upon more and more debt to keep economies functioning.

- 26:10 – The expansion of the money supply must continue in perpetuity, or the system will collapse.

- 26:40 – Politicians do not want the system to collapse when they are in office and be blamed for it. So, they keep borrowing money, thereby expanding the money supply. They keep kicking the proverbial can down the road, and the can keeps getting bigger, making the situation worse.

- 28: 38 – What are the consequences of printing money on such a large scale?

- Rapid decline of the US dollar.

- Loss of confidence in the US dollar.

- Fed could become the only buyer of Treasury notes, causing hyperinflation to ensue.

- Retirees on fixed incomes will have to supplement their incomes.

- Deferred maintenance on income producing properties will increase because renters can’t pay rent.

- Other countries will be affected, triggering a global crisis.

- 33:15 – “The U.S. government has a technology called a printing press (or today its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at no cost.” –Ben Bernanke, November 21, 2002

- 33:52 – History shows countries basing their monetary policy on a fiat currency always ends in disaster.

- 36:05 – Example is mentioned where Lois Lane falls from the top of a building and Superman swoops in to catch her and says, “I got you.” Lane responds with, “Who’s got you?” In other words, who’s got the US dollar since it is a fiat currency?

- 36:48 – The only real solution is to go back to currency that is backed by gold or silver.

- 37:41 – Unfortunately, there are those that are in control at the top. They don’t want this system to end, and that is why gold and silver have been artificially suppressed, making gold and silver less desirable as a medium of exchange.

- 38:10 – The Gold Anti-Trust Action Committee (GATA) suggests there is evidence of gold and silver price suppression.

- Examination of Central Bank’s gold sales

- Statement by Alan Greenspan, “Central banks stand ready to lease gold in increasing quantities should the price rise.” — July 1998

- Suspicion of bullion banks reporting gold on loan and gold on hand as one item on their balance sheets.

- Suspicion of Federal Reserve banks, reporting receivables and inventory as the same thing, which, of course, would be illegal accounting.

- 42:05 – Fiat currency gives power to governments. Real money keeps the power with people because then the government can only spend what is collected in taxes. People will stamp down increases in taxes.

- 46:08 – This game cannot go on forever. At some point, people will demand physical gold and silver.

- 51:00 – Greatest wealth transfer in history is coming and thereby the greatest opportunity.

- Get out of currency and get into physical gold or silver

- Get financially educated

- Find out what is going on and empower yourself

- 54:45 – Recommended reading list:

- Currency Wars: The Making of the Next Global Crises by James G. Rickards

- Geheime Goldpolitik (“Secret Gold Policy”) by Dimitri Speck

- When Money Dies: The Nightmare of Deficit Spending, Devaluation, and Hyperinflation in Weimar Germany by Adam Fergusson

- The Creature from Jekyll Island: A Second Look at the Federal Reserve by G. Edward Griffin

- Crash Proof 2.0: How to Profit from the Economic Collapse by Peter Schiff

- The Collapse of the Dollar and How to Profit from It: Make a Fortune by Investing in Gold and Other Hard Assets by James Turk & John Rubino

- Guide to Investing in Gold and Silver: Protect Your Financial Future by Mike Maloney

Check out what I am doing

To check out what I am doing with silver, go to Steve’s Silver Ventures.

Disclaimer

The above represents the opinion of Steve Sands, not only in terms of what each author has stated, but also his and based on the time of writing. Mr. Sands’ opinions are his own and are not a recommendation or an offer to buy or sell securities, commodities and/or cryptocurrencies. As trading and investing in any financial market may involve serious risk of loss, Mr. Sands recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and always do your own due diligence and research when making any kind of a transaction with financial ramifications. Although Mr. Sands has an MBA with a concentration in finance, he is not a Registered Securities Advisor; therefore, Mr. Sands’ opinions and analysis on the markets, including stocks, commodities and cryptocurrencies are his own and cannot and should not be construed as a solicitation to buy or sell.